Property Tax Rate Elbert County Colorado . Property tax payments are accepted through the drive through, drop box, mail, and on our online. elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). Discover, list, classify and value. Property tax calculations (pdf) calculation worksheet with formula to determine. property tax assessment for residential property. welcome to elbert county, co eagleweb. The assessor's four primary functions: the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. property tax calculation documents & links. The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax year. Elbert county is rank 22nd out of. If you need to find your property's most recent tax. for comparison, the median home value in elbert county is $346,400.00.

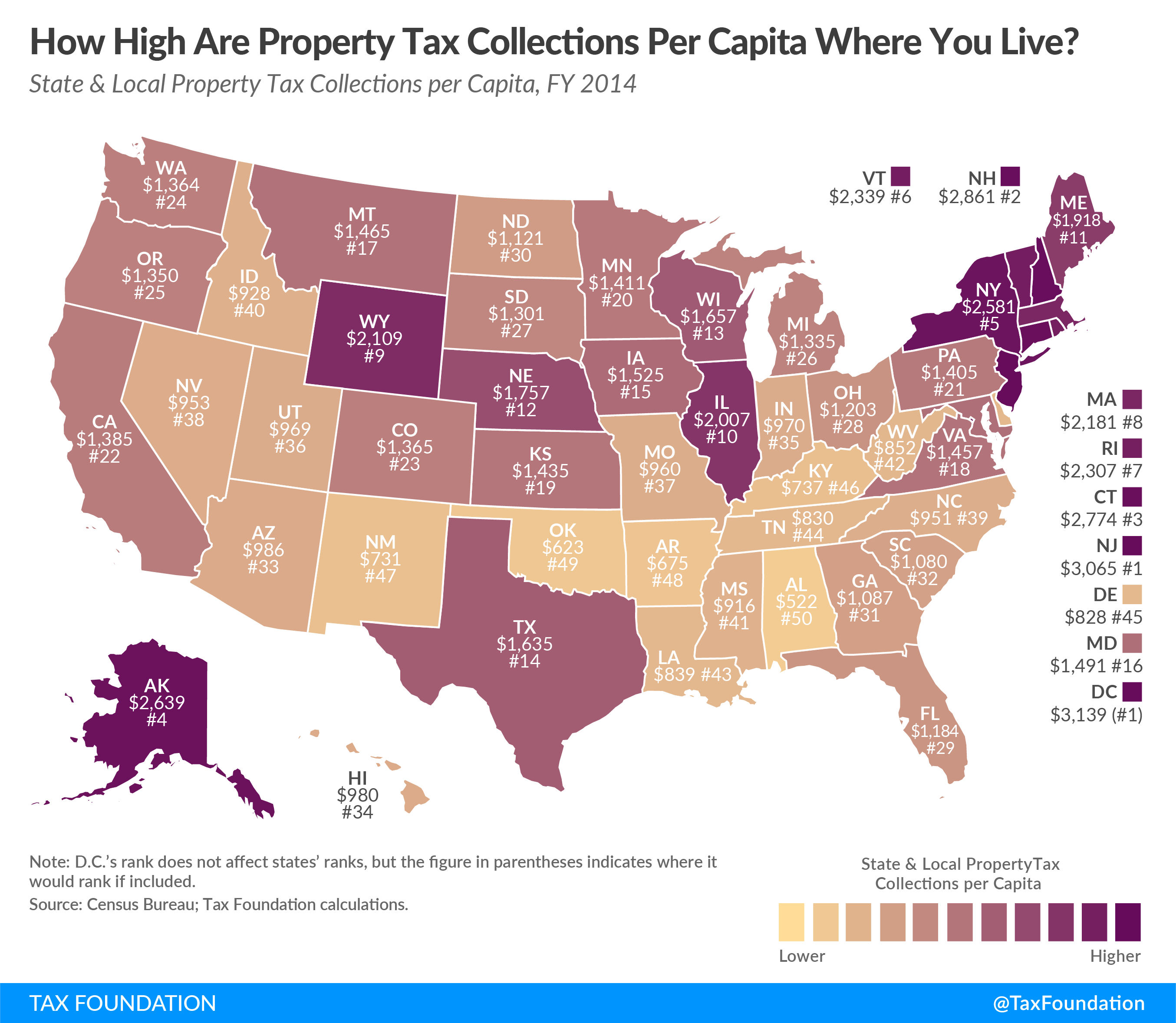

from taxfoundation.org

the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. If you need to find your property's most recent tax. welcome to elbert county, co eagleweb. The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax year. Elbert county is rank 22nd out of. Discover, list, classify and value. Property tax calculations (pdf) calculation worksheet with formula to determine. property tax calculation documents & links. property tax assessment for residential property. for comparison, the median home value in elbert county is $346,400.00.

How High Are Property Tax Collections Where You Live? Tax Foundation

Property Tax Rate Elbert County Colorado If you need to find your property's most recent tax. welcome to elbert county, co eagleweb. Elbert county is rank 22nd out of. The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax year. The assessor's four primary functions: property tax calculation documents & links. property tax assessment for residential property. elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). If you need to find your property's most recent tax. the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. Property tax calculations (pdf) calculation worksheet with formula to determine. Property tax payments are accepted through the drive through, drop box, mail, and on our online. Discover, list, classify and value. for comparison, the median home value in elbert county is $346,400.00.

From itrfoundation.org

Property Tax Rate Limits ITR Foundation Property Tax Rate Elbert County Colorado the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. The assessor's four primary functions: Discover, list, classify and value. welcome to elbert county, co eagleweb. property tax calculation documents & links. elbert county (0.44%) has a 10.2% lower property tax than. Property Tax Rate Elbert County Colorado.

From hikinginmap.blogspot.com

Elbert County Colorado Map Hiking In Map Property Tax Rate Elbert County Colorado The assessor's four primary functions: Discover, list, classify and value. for comparison, the median home value in elbert county is $346,400.00. Elbert county is rank 22nd out of. Property tax calculations (pdf) calculation worksheet with formula to determine. property tax assessment for residential property. the median property tax (also known as real estate tax) in elbert county. Property Tax Rate Elbert County Colorado.

From mentorsmoving.com

Kern County Property Tax [2024] ? Bakersfield & Kern County Property Tax Rate & Payments Property Tax Rate Elbert County Colorado If you need to find your property's most recent tax. The assessor's four primary functions: Property tax payments are accepted through the drive through, drop box, mail, and on our online. the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. property tax assessment. Property Tax Rate Elbert County Colorado.

From www.youtube.com

2024 Steuben County budget proposes 7.48 drop in property tax rates; slight increase in levy Property Tax Rate Elbert County Colorado elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). If you need to find your property's most recent tax. Property tax payments are accepted through the drive through, drop box, mail, and on our online. the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year,. Property Tax Rate Elbert County Colorado.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Property Tax Rate Elbert County Colorado property tax assessment for residential property. If you need to find your property's most recent tax. elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). Property tax calculations (pdf) calculation worksheet with formula to determine. Property tax payments are accepted through the drive through, drop box, mail, and on our online. Elbert. Property Tax Rate Elbert County Colorado.

From www.vectorstock.com

Map of elbert county in colorado Royalty Free Vector Image Property Tax Rate Elbert County Colorado The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax year. The assessor's four primary functions: Discover, list, classify and value. property tax calculation documents & links. If you need to find your property's most recent tax. for comparison, the median home value in elbert county is $346,400.00. Elbert county is rank 22nd. Property Tax Rate Elbert County Colorado.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate Elbert County Colorado property tax assessment for residential property. for comparison, the median home value in elbert county is $346,400.00. Property tax calculations (pdf) calculation worksheet with formula to determine. elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax. Property Tax Rate Elbert County Colorado.

From hikinginmap.blogspot.com

Elbert County Colorado Map Hiking In Map Property Tax Rate Elbert County Colorado Elbert county is rank 22nd out of. the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. for comparison, the median home value in elbert county is $346,400.00. If you need to find your property's most recent tax. The assessor's four primary functions: Discover,. Property Tax Rate Elbert County Colorado.

From rowqvinnie.pages.dev

Colorado Property Tax Increase 2024 Prudi Carlotta Property Tax Rate Elbert County Colorado If you need to find your property's most recent tax. Discover, list, classify and value. elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). property tax assessment for residential property. Property tax payments are accepted through the drive through, drop box, mail, and on our online. for comparison, the median home. Property Tax Rate Elbert County Colorado.

From dxonivkfc.blob.core.windows.net

Warren County Mo Personal Property Tax Rate at Gretchen Gray blog Property Tax Rate Elbert County Colorado Property tax payments are accepted through the drive through, drop box, mail, and on our online. property tax calculation documents & links. elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). The assessor's four primary functions: the median property tax (also known as real estate tax) in elbert county is $1,880.00. Property Tax Rate Elbert County Colorado.

From www.ezhomesearch.com

Your Guide to Colorado Property Taxes Property Tax Rate Elbert County Colorado Elbert county is rank 22nd out of. for comparison, the median home value in elbert county is $346,400.00. If you need to find your property's most recent tax. Discover, list, classify and value. The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax year. property tax calculation documents & links. welcome to. Property Tax Rate Elbert County Colorado.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate Elbert County Colorado property tax assessment for residential property. The assessor's four primary functions: Property tax calculations (pdf) calculation worksheet with formula to determine. If you need to find your property's most recent tax. The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax year. property tax calculation documents & links. elbert county (0.44%) has. Property Tax Rate Elbert County Colorado.

From www.mapsofworld.com

Elbert County Map, Colorado Map of Elbert County, CO Property Tax Rate Elbert County Colorado Property tax calculations (pdf) calculation worksheet with formula to determine. the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. Property tax payments are accepted through the drive through, drop box, mail, and on our online. The assessor's four primary functions: Discover, list, classify and. Property Tax Rate Elbert County Colorado.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate Elbert County Colorado Discover, list, classify and value. The bill lowers assessment rates and extends value reductions beginning in the 2024 property tax year. The assessor's four primary functions: elbert county (0.44%) has a 10.2% lower property tax than the average of colorado (0.49%). Elbert county is rank 22nd out of. property tax assessment for residential property. Property tax calculations (pdf). Property Tax Rate Elbert County Colorado.

From www.joancox.com

Property Tax Rates Property Tax Rate Elbert County Colorado Property tax payments are accepted through the drive through, drop box, mail, and on our online. Property tax calculations (pdf) calculation worksheet with formula to determine. The assessor's four primary functions: Elbert county is rank 22nd out of. If you need to find your property's most recent tax. the median property tax (also known as real estate tax) in. Property Tax Rate Elbert County Colorado.

From www.uncovercolorado.com

Elbert County, Colorado Map, History, Towns in Elbert Co. Property Tax Rate Elbert County Colorado property tax calculation documents & links. The assessor's four primary functions: property tax assessment for residential property. for comparison, the median home value in elbert county is $346,400.00. Property tax calculations (pdf) calculation worksheet with formula to determine. Property tax payments are accepted through the drive through, drop box, mail, and on our online. Elbert county is. Property Tax Rate Elbert County Colorado.

From www.expressnews.com

Map Keep current on Bexar County property tax rate increases Property Tax Rate Elbert County Colorado property tax assessment for residential property. the median property tax (also known as real estate tax) in elbert county is $1,880.00 per year, based on a median home value of. property tax calculation documents & links. Discover, list, classify and value. welcome to elbert county, co eagleweb. Property tax payments are accepted through the drive through,. Property Tax Rate Elbert County Colorado.

From www.realtor.com

Elbert, CO Real Estate Elbert Homes for Sale Property Tax Rate Elbert County Colorado property tax assessment for residential property. Property tax calculations (pdf) calculation worksheet with formula to determine. property tax calculation documents & links. Elbert county is rank 22nd out of. Property tax payments are accepted through the drive through, drop box, mail, and on our online. the median property tax (also known as real estate tax) in elbert. Property Tax Rate Elbert County Colorado.